Theft by Inflation

The Sinful Manipulation of Weights & Measures

& Alexander William Salter

Inflation plagues the U.S. economy. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index rose 9.1 percent in June 2022 from a year prior, the sharpest increase in 40 years. This grim picture looks even worse when we focus on specific sectors. Food prices rose 10.1 percent, and energy prices a whopping 34.6 percent, over the year. The price of gasoline in June averaged more than $5.00 per gallon for the first time. In some urban areas, regular unleaded topped $8.00 per gallon. That means filling up cars with normal-sized tanks can cost $100 or more.

There’s no way to sugarcoat it: American families are having their budgets squeezed. Wages are rising, but significantly less than inflation. According to the Economic Policy Institute, compensation increased about 5 percent, over the year, which means that despite rising wages, workers are losing purchasing power overall. The difficulties are particularly severe for households of limited means. When the necessities of life get more expensive, families living on $50,000 a year are harmed more than families making $100,000 per year. A given price increase eats up a larger share of the former’s budget. We should never lose sight of the human costs of inflation, especially for the economically disadvantaged.

We know that too much money chasing too few goods causes inflation. Policy-wise, we might not be able to do anything about the “too few goods” part. But the “too much money” part is a straightforward consequence of excessively loose monetary policy. Now economists and policymakers are in a difficult spot, trying to ease inflationary pressures without upsetting markets. While we wish them well, we worry that the moral—and specifically the theological—aspects of a weakening dollar will get drowned out by policy wonkery.

How should Christians think about inflation? What does it mean for central bankers to be faithful stewards of citizens’ purchasing power? After reviewing some biblical and theological foundations for a Christian ethic of monetary policy, we will augment that framework by exploring the effects of contemporary monetary policy, focusing on the “least of these” among us (cf. Matt. 25:31–46).

What Does the Bible Say?

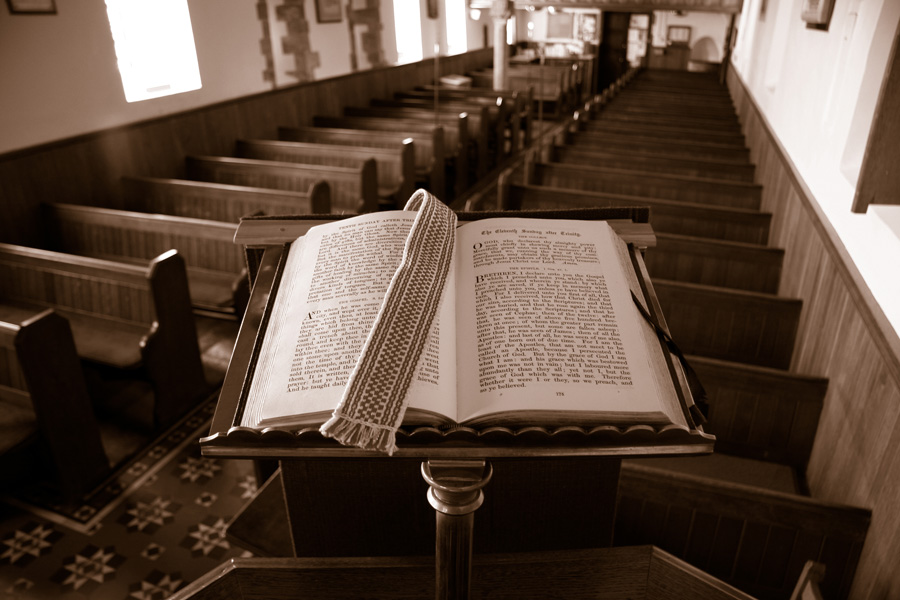

Perhaps surprisingly, the Bible has plenty to say about monetary policy. Between Exodus, Leviticus, and Numbers, there are 25 references to “the shekel of the sanctuary.” The Lord instructed Israel, as part of the Law of his covenant with them, to have a standard of weight—“twenty gerahs,” according to Exodus 30:13—for their currency in order to assure its consistent value. A shekel of this weight was kept in the tabernacle to ensure against transactions involving debased or counterfeit currency.

Why is this important? First of all, it is dishonest to tell someone you will pay him a certain amount but then to disguise the fact that you are really paying him less. Second, paying one’s debts in currency you’ve depreciated is a form of theft and therefore an injustice. As the Lord tells Israel, “You shall do no injustice in judgment, in measurement of length, weight, or volume” (Lev. 19:35). So also, “Diverse weights and diverse measures, / They are both alike, an abomination to the Lord” (Prov. 20:10). Without a stable currency, commercial justice—perhaps even commerce itself—becomes impossible. By contrast, the Lord promises blessings to Israel if the people maintain monetary discipline: “You shall have a perfect and just weight, a perfect and just measure, that your days may be lengthened in the land which the Lord your God is giving you” (Deut. 25:15). As we will see, having a reliable medium of exchange is also a necessary and natural component for any economy to flourish according to modern economics.

One last biblical image is soteriological: that of the refiner’s fire (see Zech. 13:9; Mal. 3:2; Rev. 3:18) by which the purity of gold was tested and proved. This image uses the economic idea of a reliable currency as a metaphor for our salvation. As gold is tested by the refiner’s fire, the fire of God’s judgment purges away our sin in the present—or else in the age to come. There is no escaping Christ’s fearsome judgment seat.

What Does Christian Theology Say?

Christian theologians have a long history of advocating for responsible monetary policy. Their teachings, rooted in Scripture, apply timeless principles to new economic and political circumstances.

Ancient Christian Theologians

With regard to dogmatics, St. John Chrysostom uses the metaphor of authentic currency in his Commentary on Galatians to emphasize the necessity of maintaining fully orthodox doctrine: “As he who but partially pares away the image on a royal coin renders the whole spurious, so he who swerves ever so little from the pure faith, soon proceeds from this to graver errors, and becomes entirely corrupted.” Even seemingly minor heresies devalue the entire faith. In De Trinitate,St. Augustine, representing the height of mystical speculation in this regard, even saw an image of the Trinity in the aspects of number, weight, and measure in the created world.

From an ascetical standpoint, St. John Cassian records in his Conferences the teachings of St. Moses the Ethiopian on discernment, where our perception regarding the authenticity and value of money teaches us about the discernment we need in discriminating between true and sinful thoughts:

[T]hose thoughts which falsely promise works of religion should be rejected by us as forged and counterfeit coins . . . and [we should] refuse those whose weight and value the rust of vanity has depreciated and not allowed to pass in the scales of the fathers, as coins that are too light, and are false and weigh too little.

To illustrate this, Abba Moses tells the story of one Abba John, who through an overzealous fast at the prompting of the devil, caused himself spiritual harm: “he was deceived by a counterfeit coin, and, while he paid respect to the image of the true king upon it, was not sufficiently alive to the question whether it was rightly cut and stamped.” Christ presumed his disciples would fast (see Matt. 6:16–18), and thus we may discern the “image of the true king” in the desire to do so. But Jesus never commands us to do so to the point of harming ourselves—the coin must also be “rightly cut and stamped,” not to mention of appropriate weight.

Beyond these spiritual metaphors of stable and authentic currency, St. Augustine elsewhere observed in On Christian Doctrine how different nations have different currencies and standards of value

Among the convenient and necessary arrangements of men with men are to be reckoned . . . the arrangements as to weights and measures, and the stamping and weighing of coins, which are peculiar to each state and people, and other things of the same kind. Now these, if they were not devices of men, would not be different in different nations, and could not be changed among particular nations at the discretion of their respective sovereigns.

While one might draw the conclusion from this that it doesn’t matter to him whether a nation changes the standard of value for its currency, his point is rather simply that it can, not whether and how it should.

Early Modern Theologians

In the early modern era, we see the beginnings of modern economic thought in the works of moral theologians from what is known as the School of Salamanca in Spain, due to the influence of its teacher Francisco de Vitoria (1483–1546). Not everyone who is considered part of this school studied or taught there—it references a school of thought more than the specific location. For example, one of the school’s exponents, the Spanish Jesuit Luis de Molina (1535–1600), spent most of his career in Portugal.

Molina further examined St. Augustine’s point about the varying values of currencies among kingdoms in A Treatise on Money, part of his larger work, On Justice and Right (De iustitia et iure). Molina sought to evaluate the moral status of currency exchange, and in the process touched on the importance of a stable currency. Addressing the question of usury, he noted that if one were to lend money that would be devalued at the date of repayment due to an increase in the money supply, it would be licit and just for the lender to be compensated. Thus, inflation justifies a charging of interest on loans, within reasonable rates, that does not fall under the sin of usury.

More directly, Juan de Mariana (1536–1624), another theologian of the School of Salamanca, wrote an entire treatise on inflationary monetary policy. Seeing the king of Spain debase the currency under the influence of advisors who claimed that such a policy would be in the empire’s best interest, Mariana penned his Treatise on the Alteration of Money. The king and his advisors did not take the criticism well—Mariana was imprisoned for about a year. But the wrath of kings and courtiers couldn’t change the fact that Mariana had history, Scripture, Christian Tradition, and natural law on his side. He noted that throughout history, monarchs attempted to debase their currency for personal and national gain—and they always ended up regretting it. As he wrote:

[I]f the king is the director—not the master—of the private possessions of his subjects, he will not be able to take away arbitrarily any part of their possessions for this or any other reason or any ploy. Such seizure occurs whenever money is debased: for what is declared to be more is worth less.

Thus, just like the Scriptures cited above, Mariana concluded that inflationary monetary policy is a form of theft. And on the basis of the nature of money, possessions, and just government, he concluded that such policy was an injustice, irrational, and harmfully contrary to reality. Based on the Bulla in Coena Domini of Pope Leo X, he wonders, “I do not know how those who do such things can avoid . . . excommunication and censure.” Thus, he concurs with St. John Chrysostom, in this case literally and not just metaphorically, that “those who do such things” violate Christian orthodoxy, and with St. John Cassian that in doing so they not only damage others but also harm their own souls.

Clearly, how money is governed has grave real-world consequences. But what does this imply for us today? How does modern monetary policy work? And how can we evaluate it in the light of these sources?

Modern Monetary Policy

Most wealthy nations use fiat money. Fiat money is money because the government declares it so. If you go to your regional Federal Reserve Bank and present an old, crumpled $20.00 bill for redemption, you’ll be handed back a new, pristine $20.00 bill—an improvement perhaps, but still just paper. There’s no underlying promise to redeem money for a specific amount of some other commodity. From an accounting standpoint, fiat money is a liability drawn on a public organization, typically a central bank.

Ancient kings could only wish their subjects would accept mere paper promises for the fruits of their labor! Fiat money gives modern governments extraordinary power but few responsibilities. There’s no disciplining mechanism to keep the currency’s value tied to a commodity or group of commodities (like gold, silver, and other precious metals). Most governments relegate money management to central banks, whose executives are supposed to be apolitical experts. Considering the ongoing inflationary crisis in the United States (which, we should note, began months before international sanctions against Russia), we are entitled to suspect our central bankers haven’t gotten their act together.

Ancient governments had an obligation to maintain the integrity of their money. If a king chose to mint gold-based coins, that king had a corresponding duty to maintain their weight and purity. In the case of Israel, that duty was mandated by the Law of God. In Christian Rome and Byzantium, the emperor St. Constantine the Great minted a coin called the solidus that maintained a stable value for seven centuries. In the case of nations outside the influence of the Scriptures, debasing money would still be a violation of natural law, as Mariana pointed out. It would be a sin for the king to decrease the gold content of coins, forcing subjects to trade on face value instead of the underlying commodity value. This is clearly theft, just as the Bible and Christian Tradition claim it to be. But the situation confronting modern governments is trickier.

First, citizens can choose how they save. There is no requirement for private individuals to store their wealth in paper dollars or to make exchanges in dollars. We could all start transacting in gold or bitcoin if we wished. Most people use dollars anyway because it’s enormously convenient. In a sense, money is more than numbers, paper, or coins—it’s a network: the more people use the dollar, the greater the value of dollar-based commerce. As a result, today’s governments do not have an absolute moral obligation to stabilize the purchasing power of their currencies. If you choose to transact, save, and invest in dollar-denominated assets, then you assume the risk of Uncle Sam mismanaging the dollar.

But what about those who don’t have a choice? Even today, there are many who have a hard time accessing the financial system. These individuals—poorer, less educated, likely members of disadvantaged ethnic minorities—deal almost entirely in cash. They are typically “unbanked,” meaning it is too difficult for them to participate in ordinary financial intermediation. For these people, dollars are the least bad option.

Modern governments do have a responsibility to care for the poor. Bureaucrats and politicians tend to overlook marginalized communities, being distracted by their occupation with great “affairs of state.” They might advocate for a targeted program ostensibly intended to help the marginalized, but they too often ignore or downplay the unintended consequences of their policies for those same people, including monetary policy. Inflationary monetary policy, wherein even during good years the dollar loses a little bit of its purchasing power, disproportionately burdens the “least among us.” Middle- and upper-class individuals don’t have a hard time coping with inflation. Along with most prices, wages and financial assets go up when inflation rises. The problem is for those who store their wealth primarily in cash.

Since cash earns no rate of return, savings for this group lose their value whenever inflation eats away at the dollar. Imagine someone—we’ll call him John—working hard at the best job he can get, only to watch the fruits of his labor erode by 8 percent per year. After dropping out of college, John has been working at Home Depot for the last ten years, trying to support his wife and two kids. Hamstrung by student debt for a degree he failed to earn and by the rising rent for their suburban apartment, John is worried that he and his wife Mary will have to downsize from their already cramped flat or move their family into a failing school district. Home Depot gave him a decent raise last year in the midst of labor market shortages, but somehow it feels as if he’s taken a pay cut—because in fact, due to inflation, he has. So John and Mary keep having to dip into the little savings they have, the value of which inflation has also reduced through no fault of their own.

That’s the sort of situation the poor among us are in now. That’s what the Bible calls “an abomination to the Lord” (Prov. 20:10). Economists call this a classic “regressive” policy—it places monetary burdens on those who are least capable of shouldering them.

Forms of Money Change, Principles Don’t

Economists bear much of the blame for our current inflationary mess. Gone are the days (if there ever was a time) when policymakers followed the advice of Milton Friedman, who warned, “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” While some economists still affirm his sound advice today, many others, usually of an interventionist bent, have spent decades advising governments on the desirability of inflation. Just a little bit to grease the wheels of commerce, and things will go fine, they say.

This is one of the most persistent myths in economics. We don’t need inflation to make markets work. The wealth and poverty of nations is determined by productivity: how good workers are at turning inputs (such as water, milk, sugar, and air) into outputs (such as ice cream). In the long run, productivity has nothing to do with money. The skill of our labor force doesn’t depend on how many green pieces of paper we have in our wallets. In the short run, monetary disturbances can throw a wrench in the economy’s gears, but these disturbances are much more likely to be caused by bad public policy than prevented by it. Just look at the global financial crisis of 2008 or the post-Covid inflation of today: both resulted from central banks dropping the ball. Wall Street will do just fine. It’s the people of Main Street, like John and Mary, who are left carrying the can.

While the form of money has changed greatly since ancient times, the principles that govern its proper stewardship have not. We still need “a perfect and just weight” today. In the United States, Federal Reserve policy would not pass the test of the refiner’s fire. Nor would the dollar, for that matter. The costs of money mischief disproportionately fall on those who have the hardest time bearing them. This is a major social injustice.

St. James warned the rich men who deprived workers of their wages that they were under the Lord’s judgment (James 5:4–8; cf. Ex. 22:23; Deut. 15:9, 24:15). Likewise, those who mismanage the nation’s money should beware they do not cite abstract “reasons of state” as an excuse to ignore God’s commands to remember the poor, maintain a stable currency, and refrain from theft. Such policymakers may be well-intentioned. But their intentions won’t help those squeezed by rising prices for food, energy, clothing, and shelter. Depriving them of full compensation for their labor and unduly taxing them by the diminishing value of their savings are serious injustices.

For the Sake of His Image

There is one final biblical teaching about currency we should mention, though it has more to do with the image on a coin than its purity. When asked by the Pharisees whether it was “lawful to pay taxes to Caesar,” Jesus told them to look at a denarius, a coin of the Roman currency used in the first century. “Whose image and inscription is this?” he asked. “Caesar’s,” they replied. “Render therefore to Caesar the things that are Caesar’s,” said Jesus, “and to God the things that are God’s” (Matt. 22:17–22).

Following Christ’s implication and the spiritual teachings of Christian Tradition, we ought also to ask, “Whose image and inscription do we bear?” The answer is, “God’s.” And Jesus’ teaching is clear: We ought to render all our lives to him—yes, even the dry and technical practice of monetary policy—for the sake of his image borne by ourselves and our neighbors, “the least of these” most of all. As Chrysostom put it, “he who but partially pares away the image on a royal coin renders the whole spurious.” This includes how and why we manage the dollar. Christian love demands nothing less.

Dylan Pahman is a research fellow at the Acton Institute for the Study of Religion & Liberty, where he serves as executive editor of the Journal of Markets & Morality. He is the author of Foundations of a Free & Virtuous Society (Acton Institute, 2017).

Alexander William Salter is the Georgie G. Snyder Associate Professor of Economics in the Rawls College of Business at Texas Tech University, a research fellow at TTU’s Free Market Institute, a senior fellow with the American Institute for Economic Research’s Sound Money Project, and a senior contributor with Young Voices. He is coauthor, with Peter J. Boettke and Daniel J. Smith, of Money and the Rule of Law: Generality and Predictability in Monetary Institutions (Cambridge University Press, 2021).

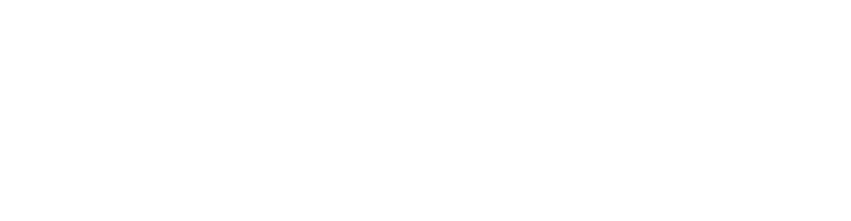

subscription options

Order

Print/Online Subscription

Get six issues (one year) of Touchstone PLUS full online access including pdf downloads for only $39.95. That's only $3.34 per month!

Order

Online Only

Subscription

Get a one-year full-access subscription to the Touchstone online archives for only $19.95. That's only $1.66 per month!

bulk subscriptions

Order Touchstone subscriptions in bulk and save $10 per sub! Each subscription includes 6 issues of Touchstone plus full online access to touchstonemag.com—including archives, videos, and pdf downloads of recent issues for only $29.95 each! Great for churches or study groups.

Transactions will be processed on a secure server.

more on Christianity from the online archives

8.4—Fall 1995

The Demise of Biblical Preaching

Distortions of the Gospel and its Recovery by Donald G. Bloesch

more from the online archives

calling all readers

Please Donate

"There are magazines worth reading but few worth saving . . . Touchstone is just such a magazine."

—Alice von Hildebrand

"Here we do not concede one square millimeter of territory to falsehood, folly, contemporary sentimentality, or fashion. We speak the truth, and let God be our judge. . . . Touchstone is the one committedly Christian conservative journal."

—Anthony Esolen, Touchstone senior editor