Editorial

The Fog of Money

Bubbleheadedness & the General Law of Chickens

by S. M. Hutchens

In the second edition of David Wiedemer et al.'s Aftershock: Protect Yourself and Profit in the Next Global Financial Meltdown (2011) the authors describe the fundamental difference between natural economic cycles reflected in the periodic rising and falling of values in various markets, and a "bubble economy," in which monetary values, primarily through what I would identify as devotion to four or five of the Deadly Sins, combined with false optimism, lack of common sense, and ignorance of history, become inflated far past their actual worth.

The authors, who have made a reputation in the financial world for being storm crows of phenomenal accuracy (this book is a New York Times bestseller), remind their readers that bubbles eventually burst, as they already have in the housing market, with disastrous consequences for individuals, corporations, and governments. They predict that the bursting of a money bubble vigorously abetted by the Federal Reserve's "quantitative easing" ("money printing") programs, will, some time within the next several years, demonstrate to the consternation if not the ruin of many stockholders how the current vigor (at least as I write) of the market is a short-lived and artificially sustained illusion. Wiedemer recommends getting out of the stock and other markets (unless one is, or hires, an expert who knows what to buy and sell during a crisis), and thinks well of buying gold.

Given the status of the authors, who are not alone in their pessimism, one wonders why more people don't seem interested in supporting measures to stop the madness, measures intended at the very least to soften the blow of the collapse that the economic Cassandras now regard as inevitable. A little trip to the website of a company some of whose funds I own shows their chief economist guardedly predicting a good future for the stock market, presumably to the end that his clients will not panic. Only a few seem to be running for the exits at this point—and why should they, when most of what they own is up and still climbing while Chairman Bernanke continues to turn the money crank, too well Keynesianized, perhaps, to consider the possibility of a future viewed from the underside of the bus.

One must make his own decisions among competing experts, and I do not have the background to subject Wiedemer's analysis to an economist's critique, much less to make investment recommendations to believers who take their responsibility to study the art of stewardship seriously. The Lord indeed said we are not to lay up treasures on earth, but he also said that we are responsible for whatever worldly goods we have been entrusted to manage. The old canard that "Jesus saves, but Moses invests" exaggerates the otherworldly quality of Christianity, for Christians also invest in this world, and are called upon to do it well. They invest, however, or should be investing, to give well, and with an infinitely higher end in view than their own comfort and security.

Virulent Madness

What interests me most about Wiedemer's theory is the plausibility it derives from a realistic view of the economic life of modern men who live in a hybrid world comprised of a kind of Rousseauian state of nature and Cloud-Cuckoo Land, where there are few economic laws in creation that cannot be wished away by superior minds. Where this mood prevails, so far as a Lawgiver may exist it would seem we can be assured of a divine liberality that wants a chicken in every pot—but a general law of chickens that says they finally come home to roost? That we can work our way around.

Chesterton has been cited as observing that a man who stops believing in God doesn't start believing in nothing, but in anything. Whether Chesterton said it or not, the maxim is worth contemplating. If it is right—and I think it is, for we are surrounded on every side by intelligent believers in every kind of nonsense—"anything" applies to everything. When a society defies the laws of God, we are wise to expect the madness to reach all its parts.

It is, after all, a very old observation that whom the gods wish to destroy, they first make insane. A nation that wishes to see no evil in butchering its children or in regularizing sodomy may be expected to establish its pleasure principle in economic policy as well. Those who fear the Lord are wise to order their lives with this in mind.

S. M. Hutchens is a senior editor and longtime writer for Touchstone.

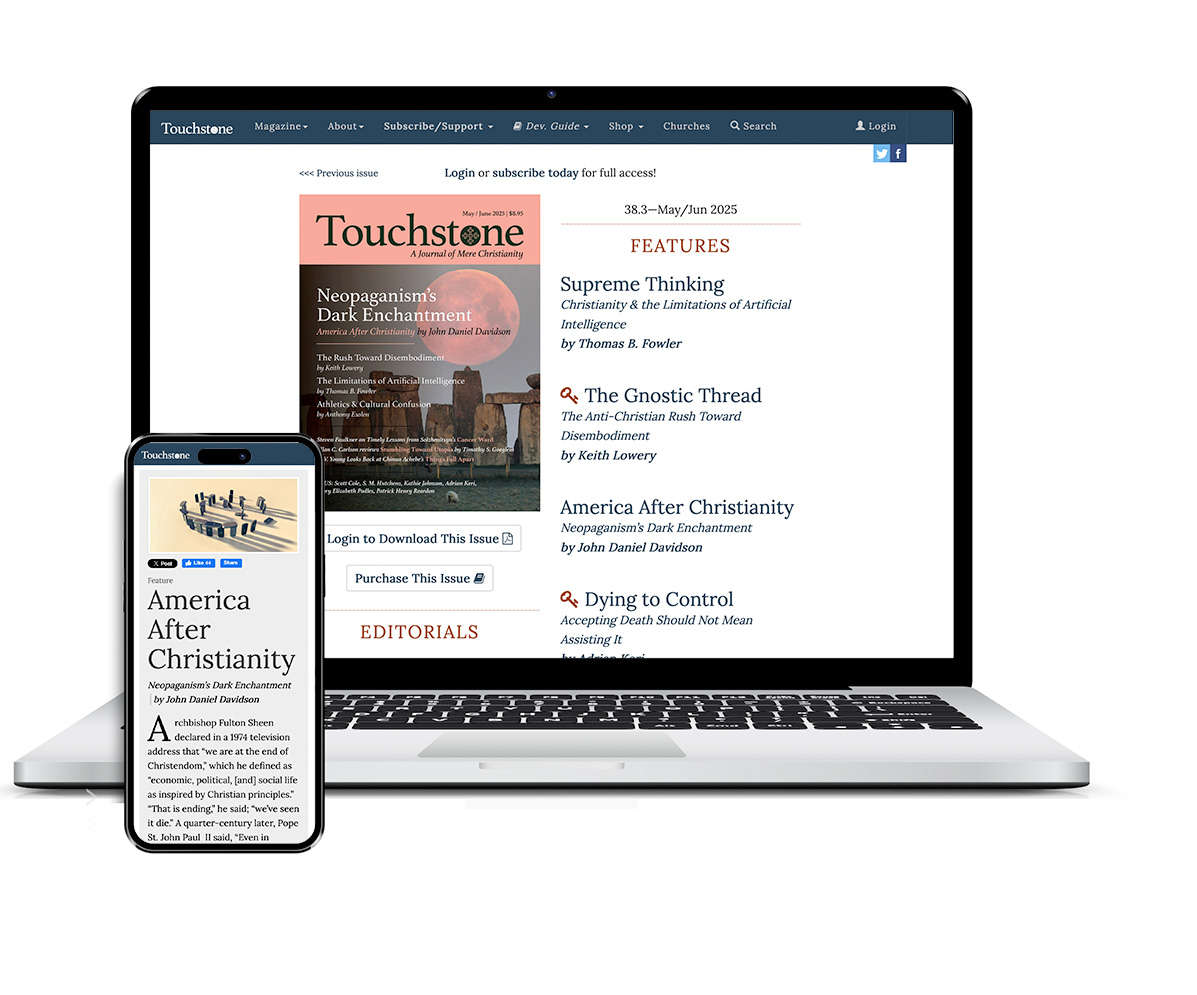

subscription options

Order

Print/Online Subscription

Get six issues (one year) of Touchstone PLUS full online access including pdf downloads for only $39.95. That's only $3.34 per month!

Order

Online Only

Subscription

Get a one-year full-access subscription to the Touchstone online archives for only $19.95. That's only $1.66 per month!

bulk subscriptions

Order Touchstone subscriptions in bulk and save $10 per sub! Each subscription includes 6 issues of Touchstone plus full online access to touchstonemag.com—including archives, videos, and pdf downloads of recent issues for only $29.95 each! Great for churches or study groups.

Transactions will be processed on a secure server.

more from the online archives

calling all readers

Please Donate

"There are magazines worth reading but few worth saving . . . Touchstone is just such a magazine."

—Alice von Hildebrand

"Here we do not concede one square millimeter of territory to falsehood, folly, contemporary sentimentality, or fashion. We speak the truth, and let God be our judge. . . . Touchstone is the one committedly Christian conservative journal."

—Anthony Esolen, Touchstone senior editor